Mobile boom and bust – what will drive online growth after smartphones?

By Andy Mulcahy, Strategy and Insight Director, IMRG

There’s little doubt that growth for the UK online retail market has been sustained in recent years by the huge shift in device usage. Even as recently as 2013, 75% of online sales were still being completed through desktops – with tablets accounting for the majority of the remainder and smartphones very periphery.

Over that period, as the below graph shows, smartphones have now grown to account for a significant share of online sales – reaching 32% in Q4 2017.

This is not to say that people were not using smartphones to access online sites in large numbers before that point; the first iPhone was released in 2007 and quickly became a popular model. But when it came to actually completing a purchase on a smartphone, there were other obstacles to overcome.

On the one hand, there was the confidence issue. It took a while for people to feel secure in putting their payment details into smartphones. 4G went some way to helping here as the connection was more reliable, as did the roll-out of Wi-Fi connections in our homes as well as in many public spaces. When we got toward 2015, retailers started to reap the rewards of optimising their mobile sites – before that, many featured checkout pages that didn’t render properly or forms that didn’t fit on the smaller screen (which served to erode trust in using it).

We tracked clear evidence of this growing confidence in our sales index. In the second half of 2015, year-on-year sales growth for smartphones in the IMRG Capgemini e-Retail Sales Index shot up and stayed in the 80-100% range every month for the next year or so. You can see the result of this in the above graph, as they started to secure a much stronger share of online sales over this period.

However, what comes up must come down. When very high growth is experienced it naturally comes back down again – sometimes quickly, sometimes gradually. In the case of online retail, it has done so slowly but surely as this the outlook for retail video shows. So while smartphone online retail sales growth eased into the 40-60% range in 2017, for the past three months (Dec-Feb) it has dipped below 40% (this hasn’t actually dragged online sales growth down, but that may be for a number of reasons, not least of which the recent UK-wide heavy snowfall).

This tendency for online retail sales growth to shoot up then gradually decline again is a very well-established pattern in the IMRG Capgemini e-Retail Sales index. The below graph, showing year-on-year sales growth for 2009-2019 (with 2018/19 showing forecasts), illustrates this point.

As can be seen, the pattern is for a boost in growth (in 2010, 2013 and 2016), followed by two years of declining growth. While the boost in 2010 was likely driven by a number of factors (better connectivity, areas of previously quite basic online sites were being optimised, continuing fallout from the credit crunch and perception that you get better deals online etc), in 2013 and 2016 it was primarily being driven by new devices.

In 2013, tablets started to account for a significant share of online sales (25% - that data point is actually specific to m-retail generally, which includes tablets and smartphones, but the overwhelming majority of sales were being completed on tablets at that point). Then in 2016, smartphone sales growth was experiencing its period of sharp acceleration which again drove up growth overall.

The point to understand here is that it’s not just because there was a new device that shoppers could use for accessing retail sites – the shift was in the number of contexts in which people could browse and shop on them. So, while the old established peaks for online retail site visitors were lunchtime and early evening, tablets added late evening (as people used them while watching TV on the sofa) and smartphones added the morning commute.

Put simply, the window for online shopping gets wider whenever new devices reach a certain level of adoption among shoppers.

Where to next?

What, then, will be the next device that could push up growth again if the three-year-bounce pattern in the index is to be repeated?

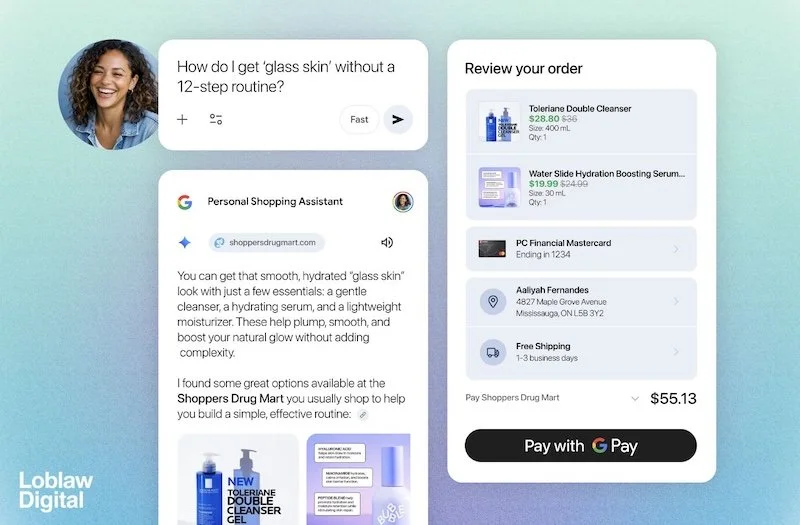

For a while, smart watches seemed like the next device to watch, but in truth they have not made sufficient in-roads to be indispensable in the same way that the smartphone has become. The smartest bet at the moment would be for voice assistants to hugely influence user behaviour over the next few years; Amazon, Google and various others tend to offer a number of different models, with the entry-level device retailing at £50 but regularly being promoted heavily during discounting periods, when the price falls to as low as £35 – which is very affordable for such an advanced piece of equipment.

Consequently, voice assistants are finding their ways into people’s homes at some scale. At present, the use-case for retail, outside of replenishing basic items, isn’t immediately obvious to the general public. But the newer models that include screens would give voice-activated shopping a visual aid that could quickly overcome this challenge.

However – the ‘next big thing’ that gives online sales growth a boost might not be a device as such, but a shift in how people shop. Many of the social platforms, such as Instagram and Pinterest, have introduced e-commerce capabilities directly onto content on their networks – making it easier and more convenient for people to shop through these platforms, on which people spend a lot of their spare time. If this catches on at scale, shopping contexts could once again multiply.

As Google were fond of saying a few years ago – ‘nothing has ever happened as fast as mobile before, and nothing will ever happen that slowly again.’ We just can’t be 100% sure what that is quite yet.

Continue reading…