Online retailers trapped between keeping loyal customers and dwindling profits amidst rise of policy abusers

A new Riskified report reveals how consumer misuse of refunds, returns, and promotional programmes, alongside resellers, is forcing retailers and other merchants to strike a difficult balance between keeping customers and accepting an inevitable loss in profits.

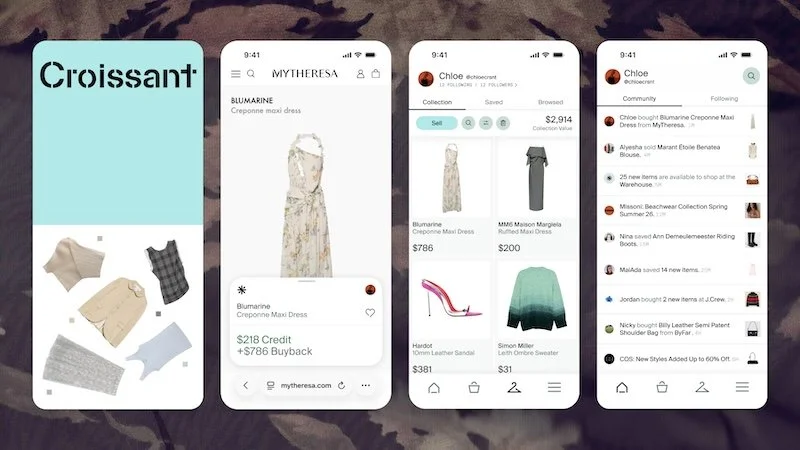

This found that policy abuse behaviours such as excessive returns, refund scams such as claiming an item was not received or returning empty boxes, abusing promotions like coupon codes or loyalty programme rewards, or reselling limited inventory items, is soaring:

90% of online merchants believe policy abuse is a significant problem for their bottom lines.

Riskified commissioned WBR Insights to interview more than 300 leaders from across a variety of online merchant organisations across the world, including United States, Australia, China, Japan, United Kingdom, Germany, Austria, Switzerland, Brazil, and Mexico.

The Wall Street Journal reported that the cost to process $100 of returned merchandise is about $26.50. Riskified’s survey found that this number is likely even higher. Two-thirds of retailers said they can recoup less than half of the total value of a returned item.

A representative from a leading fitness apparel brand that Riskified interviewed even said that, depending on item cost, their company might be better off financially if the customer broke into their warehouse and stole an item, rather than purchase and then return it.

Lenient return policies and promotion programmes are driving lost profits, yet merchants feel they must maintain their approach: 93% of retailers said it is “somewhat important” or “very important” for their organisations to offer generous refund and return policies to win new customers and retain loyal ones. 90% of respondents said they are reliant on promotions to drive sales and remain competitive.

Other key findings from the report include:

Nine out of ten online retailers said they face significant costs due to policy abuse.

Policy abuse “peaks” at certain times of year. 70% of online merchants experienced a rise in all forms of policy abuse during the summer shopping season, and two-thirds (67%) saw more policy abuse during the post-holiday returns season.

Losses from policy abuse have increased year-over-year (YoY). 57% of merchants faced increased costs from INR (item-not-received) abuse between 2021 and 2022, compared to a 45% YoY increase for reseller abuse, a 38% YoY increase for promotional code and loyalty program abuse, and 37% YoY increase for returns abuse.

According to Riskified’s data, the motivation for committing policy abuse is due to a mix of economic factors (such as inflation or entering a holiday period during which consumers have stretched disposable income) and emotional factors (such as a bad customer experience with a retailer).

Policy abuse is a unique problem for merchants to tackle because, unlike traditional fraud, it can be committed by people who are otherwise good customers, and in most cases it requires no special skills or access to stolen credentials or accounts.

An analysis of Riskified client data, for example, shows that on average 20% of all refund claims are abusive. Notably, policy abuse can cost some merchants even more than traditional fraud chargebacks, resulting in over $100 billion in losses for e-commerce merchants worldwide.

Merchants are also burdened by the operational impacts of processing refunds and returns, most of which are handled manually.

62% of merchants said they do not currently have automated systems (including machine learning) to accurately identify and address policy abuse, and 65% of respondents use a manual review process for the majority of refund and return claims. It takes most retailers (68%) three to four days to process a refund or return.

“Between Amazon fast and free returns, and popular deep discount flash sales, it has been a race to the bottom for merchants who feel that they must offer increasingly lenient programmes in order to remain competitive,” says Jeff Otto, CMO at Riskified.

“Although a wonderful experience for good consumers, a growing spectrum of hidden policy abusers have tipped the scales, deeply hurting merchant profitability. The key to solving this challenge is resolving the true identity of the consumer, extending trust and frictionless experiences to good customers, while curbing the abusers, and stopping the fraudsters.”

Continue reading…