Checkout.com report flags up demise of cash and deep and consistent change in MENA consumers’ online shopping habits

A new Checkout.com report highlights unprecedented growth in the MENA region's digital payment volumes, as the FinTech giant’s total processing value witnessed a 658% surge since the onset of 2020.

Notably, a 78% year-on-year growth between 2022 and 2023. This, according to Checkout.com, is a testament to the region's accelerated adoption of digital commerce, which continues to see a deepening consumer preference for online shopping.

Innovations such as AFT (Automated Funds Transfer) have played a pivotal role in facilitating this trend.

The findings also shed light on an increase of 56% in the number of MENA consumers engaging in e-commerce weekly or more since 2020.

Furthermore, the growth rate for daily digital shoppers in MENA surged by 80% with Saudi Arabia leading the way with a 180% growth in consumers shopping online at least once a week, followed closely by the UAE and Kuwait, each experiencing a 140% growth.

There is deep and consistent change in online shopping habits among consumers in the region, which in turn demonstrates an increased trust in the system; a barrier to adoption noted in Checkout.com’s 2020 report.

New swag alert 🔥

— Checkout.com (@Checkout) April 26, 2024

From London to Singapore, we're united in style and spirit 💙#OneTeam pic.twitter.com/cY4xyIKCcn

Additionally, the report highlights MENA consumers’ optimistic outlook on their future online spend, revealing that half of all shoppers anticipate an increase in their online spending over the next 12 months.

Particularly, online shoppers in Saudi Arabia express significant enthusiasm, with 53% anticipating an increase in their spending in the coming year.

According to a Checkout.com press release: “The increase in predictive spending demonstrates that there is resiliency and robustness to the digital economy in the MENA region.”

“Despite increasing inflationary pressures and technical recessions breaking out across other developed economies, MENA presents an oasis of opportunity for global brands to expand and develop new operations in the market.”

Demise of cash

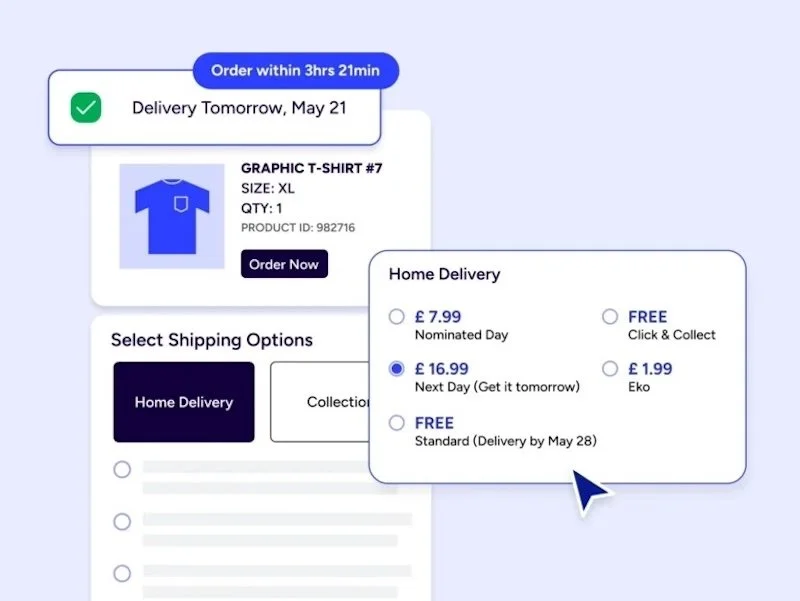

The report marks a significant shift away from cash on delivery towards digital payment methods.

Over the past 48 months, the preference for cash on delivery in the region has halved from 41% to 20%, reflecting broader acceptance and trust in digital payments, cards, and digital wallets.

This shift is notably pronounced in countries like Saudi Arabia, UAE, and Kuwait, where the preference for cash has dropped to as low as 10% among the population.

Payment security

The number of respondents ranking payment security as the most important feature offered by an e-commerce business is growing exponentially.

Furthermore, the silent revenue killer, namely false declines, continues to grow in the region with 23% reporting experiencing a falsely declined payment in the last three months.

Moreover, 33% of MENA consumers report being victims of payment fraud, and understandably, security is valued. A third of all shoppers surveyed indicated they would switch to a competitor's website following a single failed payment.

Remo Giovanni Abbondandolo, General Manager, MENA, at Checkout.com, says: “The sustained growth and rapid evolution of digital commerce in MENA are reshaping how consumers shop and pay.”

“Our report not only highlights the remarkable strides in digital payment adoption but also signals a growing confidence among consumers in the digital economy.”

“This report makes a case for the continued need for FinTechs to analyse and optimise every aspect of their e-commerce experience as consumers become more deeply connected to digital shopping and payments.”

“As our report identifies, a third of all shoppers surveyed would switch to a competitor if they experienced a single failed payment.”

“So the cost of getting your payment performance wrong has never been higher. That’s why as a payment solution provider to businesses across the region and globally, Checkout.com drives performance in this dynamic landscape.”

Continue reading…