EY research: consumers return to stores for personal service even as retail technology boosts online shopping

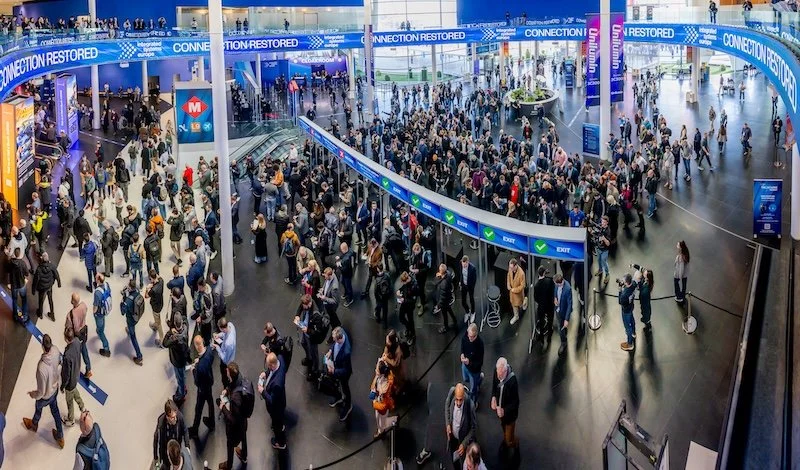

Despite technology transforming consumers’ retail experience, allowing them to seamlessly shop between online, social media, in-app and in-game, 32% of consumers still crave the personal service that only in-store shopping can provide, according to the EY Future Consumer Index (FCI) – which surveyed more than 23,000 consumers across 30 countries.

People are returning to physical stores for reasons that investment in artificial intelligence (AI) and technology alone cannot satisfy.

57% of shoppers surveyed want to see, touch and feel items before they buy them, and 68% are seeking expert advice on high value purchases to ensure they are making the most informed choices.

In a further sign that consumers are favouring physical store visits, 61% say they would go to a retailer for a store promotion that is not available online.

The report also indicates that while 68% of consumers are happy to receive and trust offers and promotions that have been personalised by AI, 49% are frustrated by smart chatbots that are not effective in resolving their queries.

A further 33% are concerned that AI generated recommendations are biased toward products/brands that may not be in their best interest.

Considering these challenges, the report suggests that consumer facing businesses must integrate personal service with complementary technology.

AI has the potential to guide consumers toward fulfilling purchase choices, however, brands and retailers’ success lies in striking the perfect balance – engaging customers at the right moment with a message or offer that resonates and that they trust.

There is also a customer service gap with people’s digital shopping experience, and this is something technology alone cannot solve.

For instance, 26% say that getting a refund or making an exchange is a source of frustration when shopping online and 30% say poor customer service/support and difficulty connecting with a customer service assistant also ranks highly.

This highlights the critical need for a more integrated approach that combines advanced technology with a strong human element to address and resolve customer frustrations effectively.

Kristina Rogers, EY Global Consumer Leader, says: “Technology is not the enemy of human interaction; rather it can be a powerful ally, and consumer companies that use it to support a human centred experience are more likely to succeed.”

“Companies must not only leverage data and analytics to gain consumer insights and anticipate future needs, but also to uncover points of friction and customer dissatisfaction that need to be addressed.”

“Striking the right balance between using technology to spot and resolve these challenges early, along with customer service training that is responsive, empathetic and creates value for the consumer, is key.”

“AI led product recommendations can deliver incremental sales, but they won’t resolve more complex, service oriented customer needs. Investing in people, both in terms of experience and knowledge, is equally as important as investing in technology, and they must go hand in hand.”

While consumers are returning to physical stores for high value purchases, the FCI reveals that the home continues to grow in its role as the centre of consumption.

Since the pandemic, more consumers are moving away from convenience and digital streaming services and are less interested in following the latest trends, spending less on grocery deliveries (38%), streaming services (35%), fashion (35%), beauty (37%) and consumer electronics (41%).

Instead, many are embracing a more grounded lifestyle, with 68% planning to reappraise how they spend their time on things they value the most – for example, 31% are planning to entertain and 47% are planning to cook more at home, compared to 29% and 39% respectively this time last year.

This preference for at-home experiences over convenience services is a response to the sustained inflationary pressures that have continued to challenge household budgets.

The research shows that 85% of consumers are concerned about their finances and 72% will be focused on value for money in the future, particularly regarding the affordability of groceries and other essentials.

This trend is not limited to the older demographics (Gen X and baby boomers) – 38% of whom plan to spend more time at home.

43% of younger generations (Gen Z and millennials), often perceived as the most social, are also embracing this shift toward more intimate and personal home-based activities. According to the FCI, 54% of younger consumers plan to cook more at home while 37% plan to entertain more.

Rogers adds: “In response to this emerging trend, consumer companies must reevaluate their strategies for engaging with consumers, particularly the younger demographic.”

“As consumers are less willing to pay for digital conveniences, businesses will need to recalibrate the role that digital channels play in driving revenue and profit margins and prioritise physical distribution outlets.”

“The trend toward more at-home experiences, including cooking and entertaining, and the move away from digital and delivery conveniences is also having a positive impact on the popularity of retailers’ private label over branded products.”

“The key lies in recognising that fulfilling physical and digital desires is not an either-or proposition. Companies must create value by adeptly navigating the digital landscape to streamline consumer experiences while also cultivating a physical presence that fosters deeper connections.”

“Achieving this balance will require new value propositions to seamlessly address both digital convenience and the craving for immediate, tangible experiences. For instance, a consumer who lacks the time to prepare a meal from scratch may still seek an engaging and inspiring culinary experience rather than simply ordering takeout.”

Continue reading…