Ocado Group ramps up retail technology sales plans as exclusivity deals come to an end

Ocado Group is gearing up for a renewed push to sell its technology worldwide as exclusivity deals with the majority of its global retail customers are switched off.

It is set to end mutual exclusivity contracts this year in most of the markets where its automation grocery tech is live, including in the US with Kroger.

Tim Steiner, Chief Executive at Ocado Group, says: “As we continue to support all of our partners to improve and grow their online businesses, we will also now bring the full range of Ocado’s AI powered and robotic solutions back to multiple markets.”

He adds: “In the five years since our first international customer fulfilment centres went live, we have substantially evolved our market leading solutions and broadened our offering to meet retailers wherever they are on their online journey. As we enter 2026, Ocado is well positioned to help more retailers capture market share in the world’s fastest growing grocery channel.”

Kroger

Retail technology only thrives when it matches the structure of the market, the rhythm of local shopping and the economics of the supply chain.

So says Elaine Parr, Senior Partner, Consumer Products and Retail Industries Leader EMEA at IBM.

She was speaking in the aftermath of Kroger announcing it would close three underperforming warehouses developed using Ocado Group’s technology.

Ocado Group will miss out on $50 million of revenue in its current financial year as a result of the closures. It will receive $250 million in compensation, while Kroger expects to incur about $2.6 billion in impairments because of the closures and its automated warehouses not meeting financial expectations.

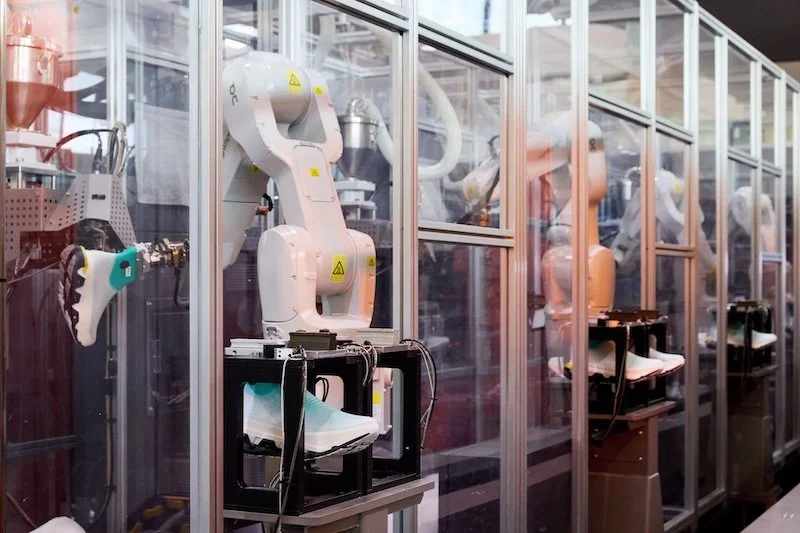

In a LinkedIn post, Parr said: “Ocado Group has been a fixture of British grocery for nearly 25 years. Founded by Tim Steiner, Jason Gissing, Jonathan Faiman. Built through years of engineering ambition and a clear belief that online grocery could be run with precision, science and scale.”

“The iconic Tim has stayed at the helm throughout. Today he is supported by a senior team that blends retail operators, robotics specialists and data leaders who have shaped one of the most advanced fulfilment systems in the sector.”

She added: “The UK business remains one of the most productive online grocery models anywhere. Strong accuracy. Strong punctuality. A model supported by heavy investment in forecasting science, smart warehouses, routing. The Ocado Smart Platform is the export. A mix of automation, software, last mile and data. Clients arrived across continents. The valuation moved with it.”

“The Kroger announcement is tough reading. Three automated customer fulfilment centres are closing. The plan was for 20. Eight opened. Three will now shut. Kroger flagged about $50 million of lost tech fee revenue for Ocado next year and the share price fell over 17%. Significant, especially with US online grocery penetration landing closer to 11% rather than the lofty forecasts seen a few years ago.”

The US is vast and uneven, Parr observed. Longer distances. Patchy population density. Mixed levels of digital adoption. Automation only works when demand density is there and when the economics stack up across picking, routing and last mile.

“The UK does not resemble the US on any of these metrics. Even Walmart sits at roughly 4% e-commerce share of its own grocery business. Behaviour changes slowly in some regions. Many consumers still prefer store pickup. Many retailers are shifting more spend into micro fulfilment rather than large central hubs. A different shape of market,” she commented.

All is not lost, however. Ocado has long-term agreements in Canada, Japan, Australia, France, and South Korea. Several have expanded their commitments over the past two years. A UK JV with M&S continues to grow volume and tighten its economics. The technology is proven, Parr argues.

“The IBM Institute for Business Value show 86% of consumer products and retail executives say AI already delivers competitive advantage and expect to invest about 3.32% of revenue in AI this year. Ocado leads in that move toward forecasting precision, smarter routing and high productivity fulfilment.”

She concluded: “This moment is a reminder of something simple. Retail tech only thrives when it matches the structure of the market, the rhythm of local shopping and the economics of the supply chain. Ocado has shaped online grocery for two decades and still does. A stumble in the US does not define a business with this much engineering depth, curiosity, brilliance and resilience.”

RTIH AI in Retail Awards

RTIH proudly presents the first edition of its AI in Retail Awards, sponsored by 3D Cloud and EdTech Innovation Hub.

This is now open for entries. Deadline for submissions is Friday, 5th December. It’s free to enter and you can do so across multiple categories.

Check out categories and entry forms here.

As we witness a digital transformation revolution across all channels, AI tools are reshaping the omnichannel game, from personalising customer experiences to optimising inventory, uncovering insights into consumer behaviour, and enhancing the human element of retailers' businesses.

With 2025 set to be the year when AI and especially gen AI shake off the ‘heavily hyped’ tag and become embedded in retail business processes, our newly launched awards celebrate global technology innovation in a fast moving omnichannel world and the resulting benefits for retailers, shoppers and employees.

Our 2025 winners will be those companies who not only recognise the potential of AI, but also make it usable in everyday work - resulting in more efficiency and innovation in all areas.

Winners will be announced at an evening event at The Barbican in Central London on Thursday, 29th January. This will kick off with a drinks reception in the stunning Conservatory, followed by a three course meal, and awards ceremony in the Garden Room.

Continue reading…