Cash no longer king but remains a vital form of payment for a sizeable minority of the UK population

The British Retail Consortium (BRC) has published its Payments Survey, showing a rise in the use of cash for the second year in a row to 19.9% of transactions in 2023 (from 18.8% in 2022).

Debit cards remained far and away the most common method of payment, increasing to 62% of transactions (66.7% by spending). Taken together with credit cards, card payments accounted for over 75% of transactions and 85% of spending.

Overall, customers visited shops more frequently but made smaller purchases, as the cost-of-living crisis continued to pinch in 2023. The total number of transactions rose from 19.6 billion to 21.0 billion while the average amount spent (per transaction) fell from £22.43 to £22.03.

Meanwhile, card fees paid by retailers continued to grow. The total amount paid by retailers to banks and card schemes rose by over 25% in 2023, at an extra cost of £380 million. This brought the total card fees paid to £1.64 billion.

According to the BRC: “Card companies continue to raise these fees without transparency or justification and retailers hope that the Payment Systems Regulator (PSR) will now implement meaningful reforms to tackle the lack of competition and rising costs identified in their current market reviews.”

Cash remains a vital form of payment for a sizeable minority of the population, particularly for its role in budgeting. This has made it important to many households during the recent cost-of-living squeeze.

All large retailers are committed to accepting notes and coins in their stores, which has a lower processing cost than other forms of payment and we welcome the new FCA rules introduced this year to support consumers’ continued access to cash. However, the dominance of cards as the preferred payment method highlights the urgency for reform on costs, the BRC argues.

It is calling for the following actions to reduce costs for retailers: The Payment Systems Regulator must, it says, implement meaningful reforms through its final reports into cross border interchange fees and scheme and processing fees to increase competition and reduce costs in the payment market.

Given the 14% rise in commercial card fees (by turnover), it wants the PSR to initiate a market review into Commercial Card interchange fees, which continue to rise unchecked, to ensure the whole payment market is functioning effectively.

It also wants to see the growth of Open Banking in the UK, without replicating the harms in the existing card system. Open Banking should be a viable alternative to cards both online and at Point of Sale, at a fairer price to retailers.

Chris Owen, Payments Policy Advisor, British Retail Consortium, says: “Persistent inflation and the cost of living crisis continued to affect households across the country and many consumers used cash to budget more effectively. However, the dominance of card payments continues apace, accounting for over 85% of spending.”

“Card fees continue to rise at a substantial rate and the PSR must act upon the harms it has identified in its current market reviews. It must move swiftly to reform the market and implement remedies including price caps on fees and price rebalancing measures.”

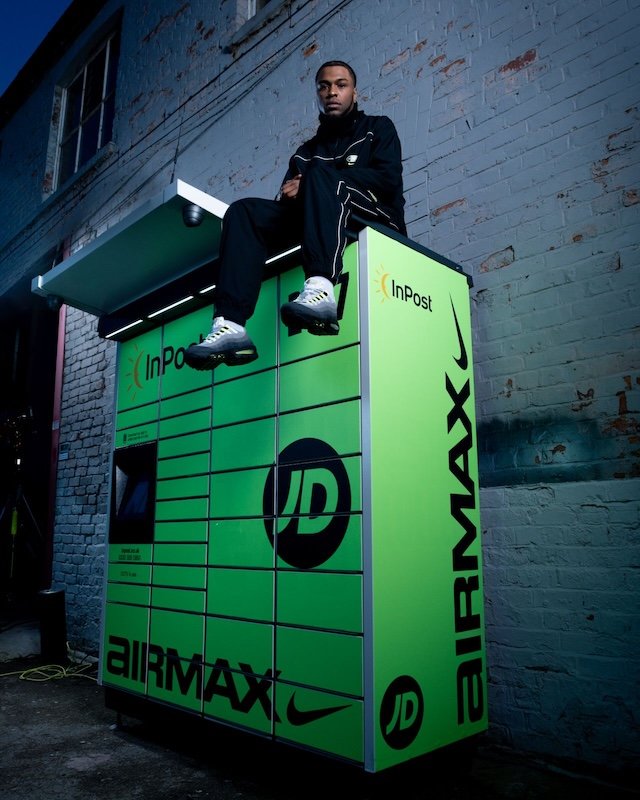

2024 RTIH INNOVATION AWARDS

Payments was a key focus area at the sixth edition of the RTIH Innovation Awards.

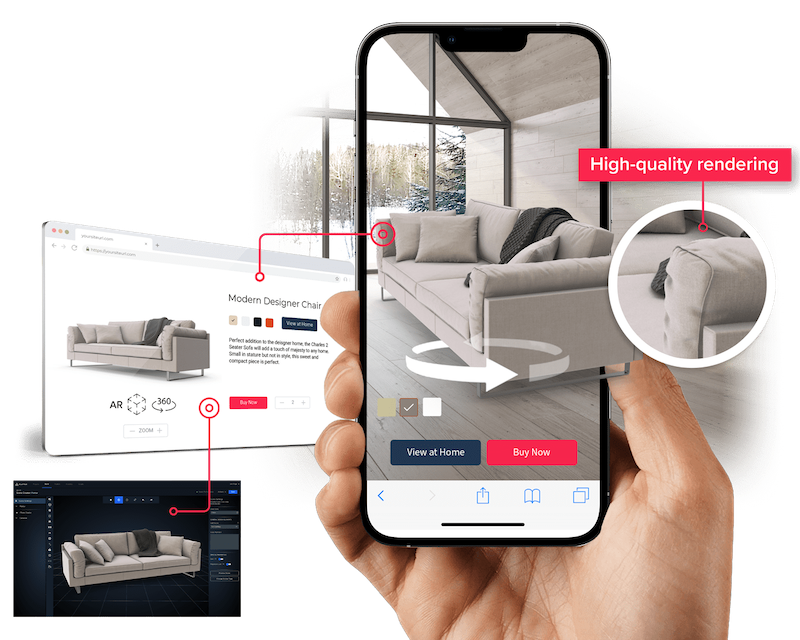

The awards, sponsored by Vista Technology Support, Scala, CADS, 3D Cloud, Brightpearl by Sage’s Lightning 50, Business France, and Retail Technology Show 2025, celebrate global tech innovation in a fast moving omnichannel world.

Our 2024 hall of fame entrants were revealed during an event which took place at RIBA’s 66 Portland Place HQ in Central London on 21st November, and consisted of a drinks reception, three course meal, and awards ceremony presided over by comedian Lucy Porter.

In his welcome speech, Scott Thompson, Founder and Editor, RTIH, said: “The event is now into its sixth year and what a journey it has been. The awards started life as an online only affair during the Covid outbreak, before launching as a small scale in real life event and growing year on year to the point where we’re now selling out this fine, historic venue.”

He added: “Congratulations to all of our finalists. Many submissions did not make it through to the final stage, and getting to this point is no mean feat. Checkout-free stores, automated supply chains, immersive experiences, on-demand delivery, next generation loyalty offerings, inclusive retail, green technology. We’ve got all the cool stuff covered this evening.”

“But just importantly we’ve got lots of great examples of companies taking innovative tech and making it usable in everyday operations - resulting in more efficiency and profitability in all areas.”

Congratulations to our 2024 winners, and a big thank you to our sponsors, judging panel, the legend that is Lucy Porter, and all those who attended last month’s gathering.

Continue reading…