Including Jisp, Virtualstock, and Big Sur AI: RTIH presents the retail technology week in numbers

Do you like numbers? Do you like retail systems news? Then this is the article for you. Including savvy shoppers in a cost-of-living crisis, AI platforms for e-commerce, checkout-free software startups, and a serious amount of McDonald’s loyalty points.

6…The US House of Representatives this week passed a bill that could see TikTok banned in America.

It would give the social media giant's Chinese parent company, ByteDance, six months to sell its controlling stake or the app would be blocked in the US.

The bill passed overwhelmingly in a bipartisan vote, and now needs to clear the Senate and be signed by President Joe Biden to become law.

It’s a move that would deal a blow to the creator economy, small businesses, and advertisers, and it has all of them scrambling to figure out their commerce strategy in its absence.

Jerry Luk, Co-Founder and President at video engagement platform, Firework, says: “In light of the potential TikTok ban, it's imperative for brands to recognise the importance of diversifying their digital presence.”

“While the future of TikTok remains uncertain, this situation underscores the necessity of investing in their own digital properties.”

$34 million…Customer journey management platform, TheyDo, has secured an additional $34 million in a Series A+ funding round.

Blossom Capital led the round, supported by other existing investors Arches Capital and Innovation Quarter and joined by global customer experience evangelist Steven van Belleghem, Highsage Ventures and 20Sales.

The round will enable TheyDo to increase R&D, focus on AI and data ingestion, and build out its customer facing team in the United States.

The startup was founded in 2019 out of the need for a solution to move beyond mapping customer journeys in large static documents to a live platform that enables a bias for action.

With TheyDo businesses are able to do strategy, planning and execution all in one place and align the silos with the customer journey.

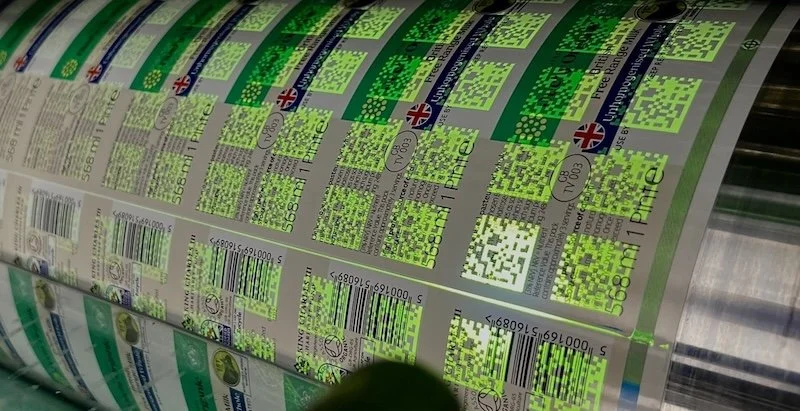

8%…In a review of its Scan & Save app’s performance through February, Jisp says it found that the total number of registered users had increased by 8% on the previous month – a rise which, it claims, points to shoppers trying to find new ways to stretch their grocery budgets amid the cost-of-living crisis.

February saw significant increases in the core metrics across the app, with scans, taps and redemptions up 45%, 43% and 42% respectively versus January.

When compared to the same period in 2023 the impact of the cost-of-living crisis is even more pronounced with increases of 150%, 177% and 174% across the same metrics.

With the Scan & Save app, shoppers can make savings on grocery lines in convenience stores. The amount people saved in February was up 38% on the previous month and up 144% on the same period in ’23.

Retailers have also been benefitting from the upturn in users and user interactions. Retail sales for February were up 27% on January ’24 returning over £500k in the month, bringing retail revenue to almost £1 million in the first two months of the year.

Total retail sales reached £3.5 million for 2023, with Jisp confident that 2024 is on track to significantly outperform the previous year’s figures.

$6.9 million…Big Sur AI, an AI platform for e-commerce, has announced a $6.9 million seed round led by Lightspeed Venture Partners and including participation from Capital F and several angel investors.

This comes as part of the launch of the company’s flagship product, an AI Sales Agent, which promises an enhanced product discovery and assisted experience to online shoppers at merchant websites.

“Big Sur AI's dedication to helping merchants cut through the noise and build lasting relationships with their customers aligns perfectly with our vision at Lightspeed,” says Sydney Sykes, Partner at Lightspeed Venture Partners.

“We believe retailers will need a personalised approach to customer engagement that persists outside of the retail store. Big Sur AI is making that kind of customer relationship automatic.”

£2 million…Checkout-free software startup Autonomo has closed a £2 million seed funding round.

This was led by London-based Potter Ventures, the team behind the inamo restaurant group, and Liverpool-based UK investors River Capital through its EIS growth fund, fund:AI.

It brings Germany born Autonomo’s total funds raised to ca. £3.8 million, with previous investment coming from a number of parties, including members of The Edeka Group, Germany’s largest supermarket corporation and angel investment from current and former directors at Aldi, Delivery Hero, Metro, Carrefour, Apple and Brookstreet Equity Partners of Mayfair.

The cash will be used to bring Autonomo’s computer vision powered checkout solutions to the UK, after going live in Germany in petrol stations, convenience and grab-and-go stores.

$60 million…Bear Robotics, a specialist in service robotics and artificial intelligence solutions, has announced the completion of a $60 million Series C funding round, exclusively led by LG Electronics.

This will take the company into new territories, targeting emerging markets such as smart warehousing and supply chain automation, where it is poised to unveil its next-generation robotics platform.

This features autonomous navigation systems and adaptive learning algorithms, designed to meet the complex demands of modern supply chains and manufacturing processes.

$200,000…Global Fashion Agenda (GFA), a non-profit organisation focused on the transition to a net positive fashion industry, has collaborated with PDS Ventures, to launch a new Trailblazer Programme.

The initiative seeks to identify fashion’s most promising early-stage innovators and support them on their journey to scale.

As part of this, PDS Ventures will award one participant an investment of up to $200,000.

The winner will also receive commercial and operational support from PDS Group’s Positive Materials - a textile company and strategic research partner supporting the development and acceleration of low impact textile innovation through collaboration between early-stage startups, supply chain partners and brands.

Further scaling opportunities will be gained through access to PDS Limited’s extensive global supply chain.

500…Robert Dyas reports that there are now 500 dropship suppliers on its online store, ranging from startups to well known brands.

Virtualstock's cloud-based SaaS platform links Robert Dyas to its network of suppliers.

This allows the retailer to swiftly and easily onboard new suppliers, and to rapidly expand its online product catalogue for an improved customer experience and enhanced online revenue.

Notably, 70% of the total gross merchandise value (GMV) for Robert Dyas now originates from dropshipping.

$10 million…Carbon-neutral courier Packfleet has raised $10 million in Series A funding.

This was co-led by General Catalyst, an early investor and Voyager Ventures, an early-stage climate fund.

All of Packfleet’s existing investors participated in the funding round, a roster that includes Creandum, Entree Capital and Founder Collective.

The cash will bolster Packfleet's presence in the London delivery market and also support the development of the firm’s proprietary routing software, Pathfinder.

Since launch in 2021, the B Corp certified courier has grown to more than 35 HQ employees, and now its 100+ drivers deliver for hundreds of businesses, including Who Gives A Crap, Pizza Pilgrims and HURR.

6…The sixth edition of the RTIH Innovation Awards is now open for entries.

The awards celebrate global tech innovation in a fast moving omnichannel world, with winners being announced during a glittering ceremony at RIBA’s 66 Portland Place HQ in Central London on Thursday, 21st November.

$1 million…Natural Dog Company, which provides health and wellness solutions for canines, has closed its 50,000 sq ft fulfilment centre after nine years of operations.

This is the conclusion of a two-year project to outsource all the US-based company’s fulfilment and manufacturing, which, it says, will save it over $1 million per year.

£2.7 million…UK-based electric fleet software specialist, Flexible Power Systems (FPS), has completed a £2.7 million financing round to accelerate commercialisation of its real-time EV and charger management platform for commercial vehicle fleets, FPS Operate.

Originally developed for John Lewis Partnership but expanded to address the needs of all commercial vehicle fleets, this integrates and operationalises charge points, vehicles, building energy management and logistics software systems.

The data is used for automated vehicle-task matching, smart charging, reporting and managing uptime, improving EV RoI.

$10 million …Resale technology specialist Treet has closed a $10 million Series A funding round.

In a LinkedIn post, Jake Disraeli, Co-Founder and CEO at Treet, said: “This funding is a testament to the tireless work our team has put in over the past three years to live up to our mission of ensuring every item lives its longest life – we do this by empowering brands to effortlessly launch their own profitable resale programmes.”

The company powers resale for more than 150 brands, including Girlfriend Collective, Ministry of Supply and Galia Lahav.

The round was led by Two Sigma Ventures with participation from previous lead investors: First Round Capital, Bling Capital, and Techstars.

Continue reading…