Ocado partner Morrisons rethinks online grocery deliveries: RTIH rustles up the retail technology week in numbers

Do you like numbers? Do you like retail systems news? Then this is the article for you. Including failed IPOs, hefty funding rounds, London Stock Exchange withdrawals, an ‘unusually subdued’ pet market, DRS legislation open letters, and the dark side of buy now pay later services.

£3 billion…Morrisons is to gradually end online grocery deliveries from Ocado Group’s automated warehouse in Erith, southeast England, and instead increasingly use its site in Dordon, central England.

Ocado said Morrisons, a partner since 2013, would also fulfil more online orders from its store network using the firm’s technology.

Tim Steiner, CEO at Ocado, says: “With our world leading technology, Ocado Retail and Morrisons offer amazing propositions in the UK online grocery market. As Morrisons reduce their operations at Erith and build their volumes in other parts of the network we are working with them to ensure seamless continuity of service to their customers and to continue strong market share growth across the UK market with the Ocado Smart Platform.”

Steiner added that reduced pressure on the Erith fulfilment centre will allow the online shopping arm of the tech business to grow.

Ocado’s grocery arm has struggled since the pandemic. At its 2021 peak, it had a market cap of £22 billion. It is now worth around £3 billion.

The offer would consist of new shares and the sale of existing shares by current shareholders.

Studenac said at the time that final terms would be released following approval of the Luxembourg Financial Supervision Authority. The aim was to raise $85.94 million from the issuance of new shares in connection with the offering.

It is now, however, ditching the initiative, citing unfavourable market conditions.

Michał Seńczuk, CEO at Studenac, comments: “During our numerous meetings and discussions with Croatian, Polish, and international investors, they have shown genuine interest in our business model, appreciation for its dynamic growth and support for our expansion plans.”

“However, due to the challenging conditions in the capital markets, we - together with our majority shareholder - have decided not to proceed with the IPO of the company’s shares.”

He adds: “We remain confident in our strategy and development direction, fully committed to continuing on this path without compromise and demonstrating to our employees, investors, and all stakeholders that we can create value for them. We extend our gratitude to all investors who have placed their trust in us throughout this process.”

$350 million…Indian quick commerce firm Zepto has landed $350 million in new funding, its third round of financing in six months, ahead of a planned IPO next year.

This maintains its $5 billion valuation.

Motilal co-founder Raamdeo Agrawal, family offices of Mankind Pharma, RP-Sanjiv Goenka, Cello, Haldiram’s, Sekhsaria, and Kalyan, as well as celebrities Amitabh Bachchan and Sachin Tendulkar are among the backers in the new round, which is the largest fully domestic primary round in India.

€26 million…Swedish firm Sitoo, a provider of cloud native PoS and unified commerce platform solutions, has announced a €26 million minority investment from Verdane.

This will help the company take advantage of what it calls a “massive opportunity” in the US and global markets while strengthening its foothold in the UK and European regions.

“We have seen Sitoo deliver on its growth ambitions with best-in-class execution by Jens Levin and the team since we first met in 2019. Back then they were a local Swedish player with big ambitions and has now become the clear market leader in the Nordics and we look forward to partner with the team to help build the business into a global category leader” says Pål Malmros, Partner at Verdane.

2…Primark has this week announced two notable new store openings, one in Bolton, UK, and one in Bydgoszcz, Poland.

In a LInkedIn post, the retailer said: “From Bydgoszcz to Bolton, it was a busy day for Primark teams as we opened the doors to two new stores.”

“In Poland, we celebrated the opening of our seventh store, in Zielone Arkady Shopping Centre, Bydgoszcz, and our first location in the north of the country. Representing a €9 million investment, we’re delighted to bring affordable fashion to more customers in the region and welcome over 150 new colleagues.”

It added: “Meanwhile, in the UK, our newly relocated Bolton store opened its doors at Market Place to over 500 eager shoppers. This location brings our exciting new store concept to the British high street for the first time, featuring a modern look and feel, more sustainable design fittings and even a unique new scent.”

“Bolton has been part of our story since 1976, and we’re proud to continue serving this vibrant community after 48 years, and counting.”

35% and 75%…Just Eat Takeaway this week announced it will delisting from the London Stock Exchange by the end of the year. The administrative burden of being dual listed in Amsterdam and London is behind the move.

Just Eat Takeaway.com was created in 2020 between a merger of the London-based Just Eat and the Amsterdam-listed Takeaway.com.

Susannah Streeter, Head of Money and Markets, Hargreaves Lansdown, says: ‘’Just Eat’s decision is a blow to the City and a setback for the government especially given its efforts to encourage more firms to list in London.”

“Just Eat cited a litany of reasons for withdrawing from the London Stock Exchange, showing just how much work still needs to be done to simplify rules to help retention and lure more firms in. Management described the administrative burden, complexity and costs associated with regulatory requirements, but also low trading volumes on the London market.”

“Opening up more opportunities for retail investors could help with trading volumes and add fresh vigour to the London market. UK retail investors are already enthusiastic holders of UK equities, around 35% hold UK equities directly with around 75% of trades by value taking place on the London market.”

“Many more clients will be investing in the UK through funds. The government’s commitment to support increased retail participation is welcome, and proposals should be accelerated into concrete action. Too many people are sat on excess cash savings which could be deployed in the stock market, delivering longer term returns and supporting the UK economy.”

She concludes: “There is untapped demand to invest in UK listings. The Raspberry Pi IPO was significantly oversubscribed by retail investors, so there are still supply side issues to fix. All too often retail investors are cut out of IPOs and secondary capital raising rounds. The Financial Conduct Authority’s recent publications on the Public Offers and Admission to Trading Regulations regime, which aims to reduces barriers for retail investors as a desired outcome, is welcome and needs to be enacted.’’

£789.1 million…Pets at Home reports that first half like-for-like revenue was up 1.6% to £789.1 million. Underlying pre-tax profit was up 14.1% to £54.5 million, with a sluggish market persisting longer than expected.

The launch of a new digital platform has seen app sales almost double. The retailer says that it has moved through the transitionary impacts that impacted web sales in H1 and has seen significant opportunities to win incremental, profitable sales in digital.

The Stafford distribution centre is, meanwhile, performing well, supporting near record availability in stores, and plans are afoot to unlock efficiency savings through automation in e-commerce into next year.

Pets at Home is also investing to improve its physical presence with three new stores and 14 refits in H1.

Derren Nathan, Head of Equity Research, Hargreaves Lansdown, says: “Pets at Home has put in a decent first half against an ‘unusually subdued’ pet market. The cumulative effect of cost-of-living increases, plus a sense check on commitments in terms of both time and money, could be making consumers think twice before adding more furry or scaled dependents to their household.”

“However, the group’s integrated model is standing it in good stead. It’s winning market share, reaping the benefits of investment in its digital platform, and seeing a strong uplift in performance of it Vets business 18.6% as it serves more of the relatively stable pet population. That’s more than offset a flat outcome in retail.”

He adds: “Strong veterinary margins are also countering keen pricing in retail. For now, it’s the Vets business that’s propping up the group. With that in mind the outcome of the Competition & Markets Authority’s investigation into the industry, expected next year, will be watched particularly closely. The group, however, doesn’t see this as a threat to the growth strategy for this division.”

“Cost control has impressed and that’s just as well. There’s an £18 million hit this year from increases in the national minimum wage and removal of business rates relief, and a similar amount to swallow next year following the October budget.”

“The valuation has been under pressure of late and that’s unlikely to reverse after today’s weakened guidance. But Pets at Home is navigating the tough market admirably and the long-term outlook for the industry is still positive. It looks well placed to benefit when demand normalises but just when that happens is difficult to call.”

100…The 2025 edition of the RTIH Top 100 Retail Technology Influencers List, sponsored by 3D Cloud, is now open for entries, with go live set for March next year.

We will be bringing you the people who made a splash in 2024 and are set for a barnstorming 2025.

RTIH is scouring the retail technology world to find the most influential figures for this comprehensive list of people and trends that shape the industry and help drive it forward.

We’re living in unprecedented times and witnessing a seismic change in shopping habits.

We are seeing retailers taking innovative technologies like AR, AI, and spatial computing, and finding ways to use them to make customer experiences more exciting and dynamic.

Which is where the RTIH Top 100 Retail Technology Influencers List comes in, presented, we should stress, in no particular order. Such disruption requires new ways of problem solving and thought leaders who can both evangelise and execute on the likes of digital transformation and omnichannel success.

60…Over 60 businesses have joined Polytag, a technology business specialising in sustainability initiatives, to call upon environment minister Mary Creagh to review Deposit Return Scheme (DRS) legislation.

An open letter calls for the removal of “return-to-retail" prescriptions, framing plans in an open way and offering modern, digital solutions that would mean consumers would be able to recycle their plastic bottles at home and still get their deposits back.

The UK is on the brink of implementing a DRS, a positive step toward a circular economy. But current DRS proposals lean toward a strictly “return-to-retail” model, where consumers would need to store plastic bottles and cans at home and then collect their deposits by using reverse vending machines (RVMs), which are usually only available at large retail locations.

In the open letter to the environment minister, Polytag calls upon the government to set the UK’s DRS up for success by allowing and encouraging at home digital scanning within the regulations, alongside the physical return of containers to shops. Polytag and Ocado Retail's world first trial back in 2023 saw over 20,000 rewards redeemed in 56 days.

1… EE has announced the grand opening of its latest Experience store in Birmingham’s Bullring.

Former England International Emile Heskey, who called Birmingham home during a five-year spell with Birmingham City and Aston Villa, will be cutting the ribbon and welcoming visitors to the new space at 12pm on Thursday 28th November.

The store has been designed to help people explore the latest in connected technology and forms part of EE's investment of more than £6 million in bricks and mortar retail this year.

It will feature Experience Zones themed around four key areas – Game, Work, Learn, and Home – along with a Tech Home area showcasing the future of connected living.

10%…The ability to use buy now, pay later schemes such as Klarna increases the amount customers spend by around 10%, according to research by Imperial College Business School.

BNPL schemes also increase customers’ willingness to buy a product, with their likelihood of buying an item increasing by nine percentage points.

The research found that people who tended to buy items online using a credit card, rather than a debit card, were more likely to spend more with a BNPL scheme. Those who were more at risk of financial difficulties were also more likely to increase their spending.

$17 million…Fresho, an order management platform for fresh food wholesalers, has announced the close of a $17 million Series B funding round, bringing total investment to $50 million to date.

The oversubscribed round welcomed both new and existing shareholders, led by Geoff Tarrant, Co-Founder and former Executive Chairman of Payapps, a construction software firm acquired by Autodesk for $600 million in 2024. Tarrant, who also served as director of ASX listed Adbri, will join Fresho's board of directors.

Founded in 2015 by James Andronis, drawing on 15 years' experience running an Australian seafood wholesaler, and Huw Birrell, a technology entrepreneur with international finance expertise, Fresho’s platform recently celebrated processing its 30 millionth order since 2016, with ten million orders in the past year alone.

"We are pleased to have closed this round in a challenging fundraising environment. This speaks to the size of the opportunity, and to our record of consistent growth and capital management to date," says Andronis.

“Fresh food distribution has been traditionally slow to adopt technology, but a confluence of factors are causing this to change. These include margin pressures, skills shortages and questions of succession in family owned firms. As a result, we are seeing unprecedented interest in how technology can drive efficient operations, better customer service, and improved work/life balance for owners and managers."

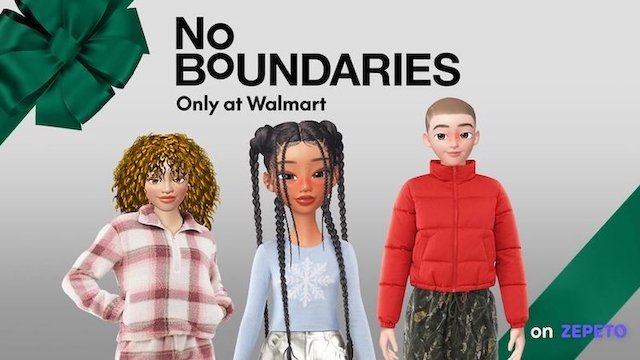

2…Walmart’s second No Boundaries drop on ZEPETO has gone live.

This drop includes ten virtual twins of real-world NoBo items from the US retail giant’s winter collection and a “cozy chalet” video booth backdrop for the ZEPETO community to create and share with their friends.

Walmart has also partnered with ZEPETO creator, TuLiP TLP to create three limited edition items inspired by the broader winter collection.

“This type of activation might not resonate with you, but it does resonate with the more than 20 million MAU on ZEPETO,” says Justin Breton, Head of Brand Marketing Innovation at Walmart.

“It’s another example of how we’re meeting the next generation of customers where they are online and empowering them to discover, try-on, and express themselves with virtual fashion, all of which translates to real-world brand love and purchase intent.”

3…Retail Insight has announced the renewal of its partnership with M&S for another three years.

The pair have worked together since 2021, with Retail Insight supporting the retailer in tackling food waste through its cloud-based, WasteInsight solution.

“Our collaboration with Retail Insight over the past three years has been incredibly impactful,” says Chris Thomas, Head of Product for Store Operations at Marks & Spencer.

“The WasteInsight solution has delivered significant waste reduction benefits over the past three years, as well as improved overall operational efficiency. We look forward to continuing to work with the team to help us meet our net zero targets.”

3…A third EDEKA Jäger store with self-checkouts and AI supported age verification has opened its doors to the public in Stuttgart Plieningen, Germany.

These are powered by Diebold Nixdorf.

In a LinkedIn post, Alexander Klein, Account Manager at Diebold Nixdorf, said: “All good things come in threes! The third EDEKA Jäger store with self-checkouts and AI supported age verification in Stuttgart Plieningen is live. In addition to a diverse assortment and regional offers, Florian Jäger sets new standards for an innovative shopping experience.”

He added: “The intuitive self-checkout solutions make the operating process even faster and more convenient for customers, especially for age restricted products. Come by and experience the future of shopping first hand! We are pleased to be able to accompany EDEKA Jäger on its journey and wish them every success with the new stores.”

2 and 25,000…PUMA has officially opened the doors to its second North American flagship store in Las Vegas at the BLVD Las Vegas. The 25,000-square-foot retail space, which spans three stories, aims to “redefine what it means to be a bricks and mortar location in today's rapidly evolving digital world”.

“I am thrilled that we are opening a state-of-the-art flagship store in Las Vegas as part of our brand elevation strategy. Located along the iconic Las Vegas Strip, this flagship allows us to expand PUMA’s presence in North America to connect with US consumers and international visitors alike,” says Arne Freundt, Chief Executive Officer at PUMA.

“I believe that our new Las Vegas Flagship is essential for conveying the true character of our brand and for creating an immersive, interactive shopping experience as it will redefine in-person shopping by seamlessly merging sports performance, latest fashion trends, and technology.”

The store features a variety of immersive and interactive features powered by technology. It offers customers attractions such as a professional F1 racing simulator, an interactive arcade, and a customisation studio where customers can personalise apparel and footwear.

Continue reading…